Cross-border bankruptcy rules and procedures in the USA, the UK and the British Virgin Islands

This note primarily reviews the recognition of restructuring and insolvency proceedings as between the United States and United Kingdom jurisdictions.[i] A key aspect of cross-border recognition is the definition of ‘centre of main interests’ (COMI). This continues to be interpreted by the UK courts in line with EU jurisprudence, notwithstanding that the Insolvency Regulation is now no longer directly applicable in the UK. In particular, the meaning of COMI (along with several other provisions) was left unchanged by the (UK) Retained Insolvency Regulation. The principal effect of the Retained Insolvency Regulation is to provide jurisdiction to the UK courts to commence insolvency proceedings in respect of a debtor where domestic UK legislation does not do so. Consequently, it appears that changes made to the UK insolvency regulations in respect of insolvency commenced after the end of the Brexit transition period therefore have few cross-border implications. We also include a summary of the position within the British Virgin Islands, where CANDEY also has an office, and which shares similar rules.

Model Law

The UNCITRAL Model Law on Cross-Border Insolvency provides the legal framework for determining when a UK or US court is able to recognise insolvency proceedings opened in the other’s jurisdiction. The Model Law was incorporated into respective US and UK national legislation: the United States implemented the Model Law in Chapter 15 of the Bankruptcy Code; the UK through the Cross-Border Insolvency Regulations 2006 (“the CBIR”). A Chapter 15 recognition proceeding is an ancillary proceeding in which the US court acknowledges the foreign proceeding is principal and gives effect to it under applicable US law. In the UK, the CBIR are supplemented by s.426 of the Insolvency Act 1986 and by the common law. UK courts therefore have to consider several principle sources of law to determine which law to apply in any given insolvency matter.

Recognition of main proceeding; ‘centre of main interests’ (COMI)

The ‘centre of main interests’ (COMI) can generally be understood as the place where a debtor conducts the administration of its interests on a regular basis and which is ascertainable by third parties when initiating or considering insolvency proceedings. The Model Law uses the concept of COMI to determine the degree to which the courts of one jurisdiction are to recognise and assist insolvency proceedings commenced in a different jurisdiction. However, COMI has been interpreted differently in the US and the UK (as well as in other signatory jurisdictions). As Lord Collins remarked in the Supreme Court in Rubin v Eurofinance, the expression COMI is “not without its own difficulties”.[ii]

In the US, pursuant to 11 USC Code §1517(b), a foreign proceeding will be recognised as a foreign main proceeding in the country where the debtor has its COMI. Paragraph 4 of the CIBR puts it slightly differently, requiring the application for recognition to contain evidence that the debtor’s COMI is within the country where the foreign proceeding is taking place. In other words, courts in both jurisdictions need to determine a foreign main proceeding based on a debtor’s COMI. However, neither Chapter 15 nor CIBR specifically defines COMI, leaving courts to define the term. Section 1516(c) provides for a rebuttable presumption that the debtor’s registered office is presumed to be its COMI. The CIBR contains a similar rebuttable presumption by virtue of the incorporation of Article 16(3) of the Model Law into the CIBR. This presumption can be rebutted by objective evidence ascertainable by third parties who deal with the company. [See Re Eurofood IFSC Ltd;[iii] Re Stanford International Bank.[iv]]

The European Court of Justice decision in Eurofood served as the guiding authority to the UK courts on third party tests, holding that COMI "must be identified by reference to criteria that are both objective and ascertainable by third parties," and that "objectivity and that possibility of ascertainment by third parties are necessary in order to ensure legal certainty and foreseeability concerning the determination of the court with jurisdiction to open main insolvency proceedings." The UK position was affirmed by Mrs Justice Proudman in Re Kaupthing Capital Partners,[v] who stated that the court “should have regard to factors already in the public domain, or which would be apparent to a typical third party doing business with the body”.

Some US courts have equated a company’s COMI with its “nerve center” or “headquarters”. [Hertz v Friend[vi]] It was concluded in another line of cases that, while the presumption of the debtor’s COMI is its place of registration or incorporation, various factors could nevertheless rebut it. In the 2007 Bear Stearns case,[vii] quoting Tri-Continental Exchange Ltd.,[viii] the court was prepared to allow the presumption that the COMI is located at the company’s registered office to be rebutted merely by evidence that the COMI “might be elsewhere”, rather than by specific evidence. In Bear Stearns, the hedge funds had no business activity at all beyond the minimum necessary to remain incorporated, the court found that they had no “establishment” in the Cayman Islands and denied relief under Chapter 15. Bear Stearns therefore rejected the discretionary approach that, two months prior, had been approved by Spinx.[ix] Bear Stearns was considered to be an extreme approach and appears not to have been followed in cases such as Re Saad Investments Finance Company.[x] Among the factors that the court may consider are the location of the debtor’s headquarters, decision makers, assets, and creditors. [Re SPhinx Ltd;[xi] Re Fairfield Sentry Limited[xii]].

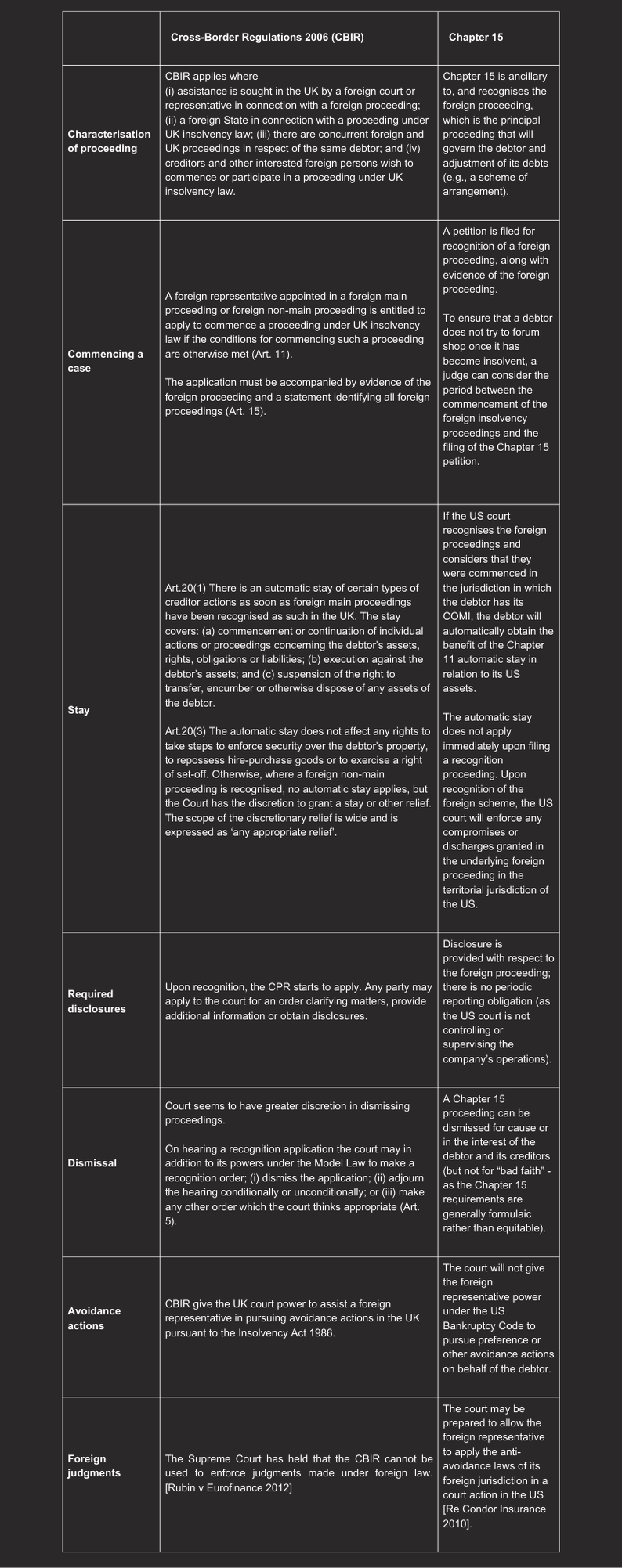

Comparison as between CBIR and Chapter 15 of miscellaneous provisions

Summary

Since Chapter 15 and CBIR are both based on the Model Law, they are highly similar. However, UK law also has to consider s.426 of the Insolvency Act 1986 (which mostly applies to Commonwealth nations) and English common law, whereas in the US Chapter 15 stands alone. Under s.426, a court in a foreign designated country or territory (“a relevant country”) can apply to the UK courts for assistance in insolvency proceedings. In cooperating with relevant country courts, the UK court has a wide discretion to apply UK insolvency law or the relevant foreign insolvency law. Under English common law, English courts may provide assistance to foreign insolvency proceedings, principles often referred to as principles of modified universalism and comity. The CBIR prevail over the Insolvency Act 1986. However, there is no express provision that the CBIR prevail over English common law. The main point of difference between the US and UK jurisdictions is the application of COMI, but even that difference appears to have stalled, as US courts appear not to be focused on diverting further from the UK interpretation.

British Virgin Islands (the “BVI”)

CANDEY also has an office in the British Virgin Islands, where we specialise in corporate and commercial, trust, fraud and insolvency litigation. While there has been prolonged discussion about adopting Part XVIII of the BVI Insolvency Act 2003 (“the BVI Act”), which incorporates the UNCITRAL Model Law, that Part of the Act is not yet in force. Instead, Part XIX provides the BVI High Court with power to grant an order in aid of office holders from certain designated countries. This list was expanded to more than twenty countries in 2024 and now includes many other Commonwealth Caribbean countries, Australia, the United Kingdom and Hong Kong. In Net International Property Limited v Erez,[i] the Eastern Caribbean Court of Appeal held that, while the previous common law power to recognise foreign insolvency practitioners survived the introduction of the BVI Act, the Court was only able to provide assistance to those from states that have been designated.

The BVI is often used as a jurisdiction for incorporating holding companies in broader corporate structures because of its favourable company law and taxation regime. As a consequence, it is common for liquidators to be appointed in the BVI and then for steps to be taken in other jurisdictions, such as the US, where downstream subsidiaries and assets tend to be located.

Note: This is a general summary of an evolving field of law, and is made available for general discussion purposes only between CANDEY and its clients, and prospective clients. This memorandum does not constitute legal advice and must not be relied on as such. It should also not be cited as legal or academic authority.

CANDEY is a boutique litigation law firm that has extensive experience and resources to evaluate and advise on cross-border bankruptcy issues. David Harby, a partner in our BVI office, is very used to working with US counsel in making Chapter 15 applications and has often been called on to provide expert evidence on BVI law in relation to the same.

[i] For simplicity of explanation, we assume that no main proceedings have commenced before the end of the UK/Brexit ‘transition period’.

[ii] [2012] UKSC 46, §13.

[iii] Case C-341/04 2006.

[iv] [2010] EWCA Civ 137.

[v] [2011] B.C.C. 338.

[vi] 559 U.S. 77 (2010).

[vii] Bankr. S.D.N.Y. 5 September 2007.

[viii] 349 B.R. 627 (Bankr. E.D. Cal. 2006) at 635.

[ix] 351 B.R. 103 (Bankr. S.D.N.Y. 2006). The court stated (at 7): “Overall, it was appropriate for the Bankruptcy Court to consider the factors it considered, to retain its flexibility, and to reach a pragmatic resolution supported by the facts found.”

[x] Bankr. D Del 17 December 2009.

[xi] 351 B.R. 103 (Bankr. S.D.N.Y. 2006.

[xii] 10 Civ. 7311 (GBD) S.D.N.Y. 15 September 2011.

[xiii] BVI HCMAP 202/0010 22 February 2021.

Partner

Consultant

January 2025

Pupil Barrister